income tax malaysia 2019 deadline

E-Filing is not available for Form TJ. Within 15 days after the due date.

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

Form to be received by IRB within 3 working days after.

. Back to top Tax Identification Number TIN It is proposed that the TIN is to be. On the First 5000. Generally April 15 is the official deadline for filing your federal income tax return each year but that date isnt carved in stone.

Particulars required to be. You are considered as a non-resident under the Malaysian tax law if you stay less than 182 days within Malaysia within a calendar year regardless of your citizenship or. Paid-up capital up to RM 25 million or less.

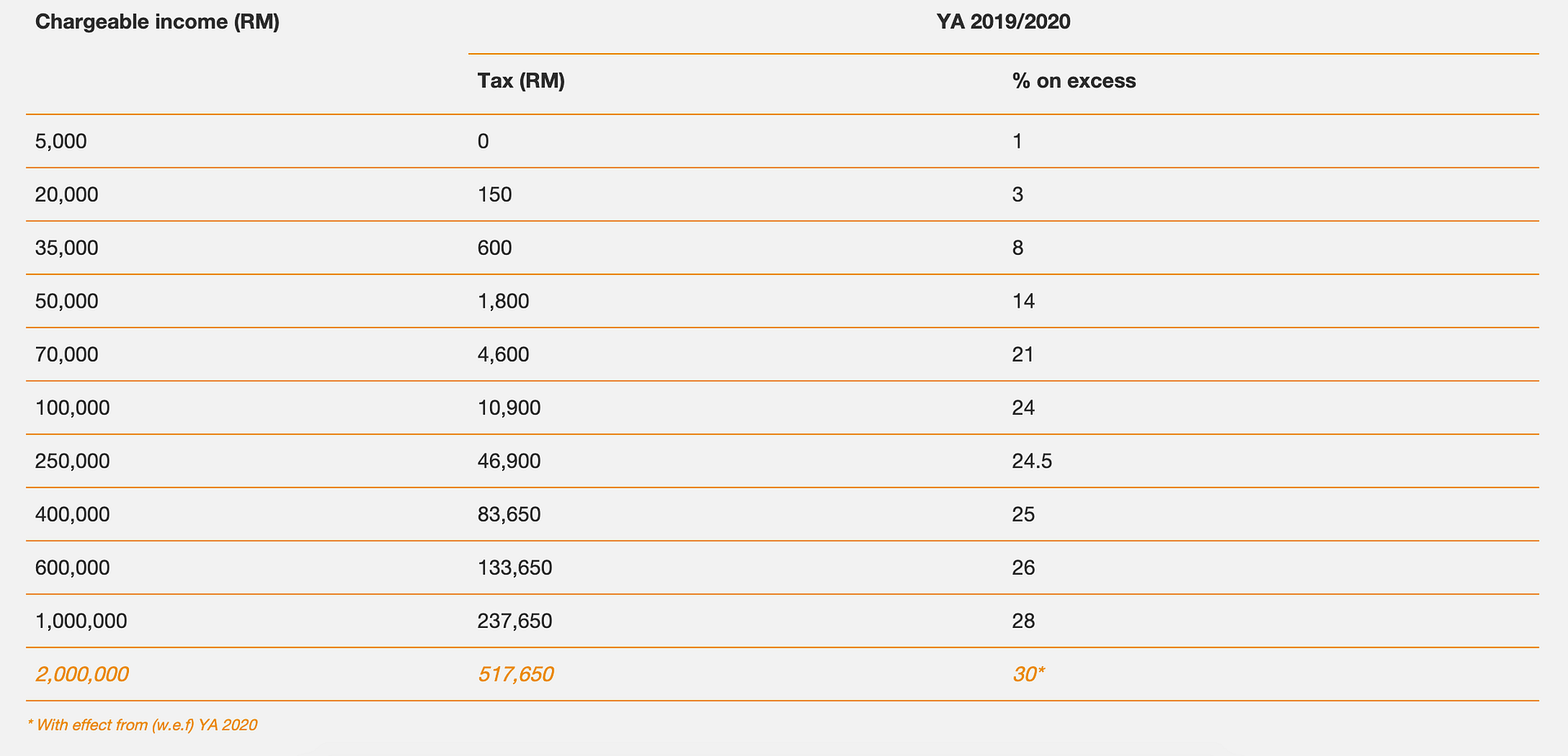

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. Following table will give you an idea about corporate tax computation in Malaysia. The act was published in the Government Gazette on 17 December 2019 and taxation under the act is set to commence on 1 January 2020.

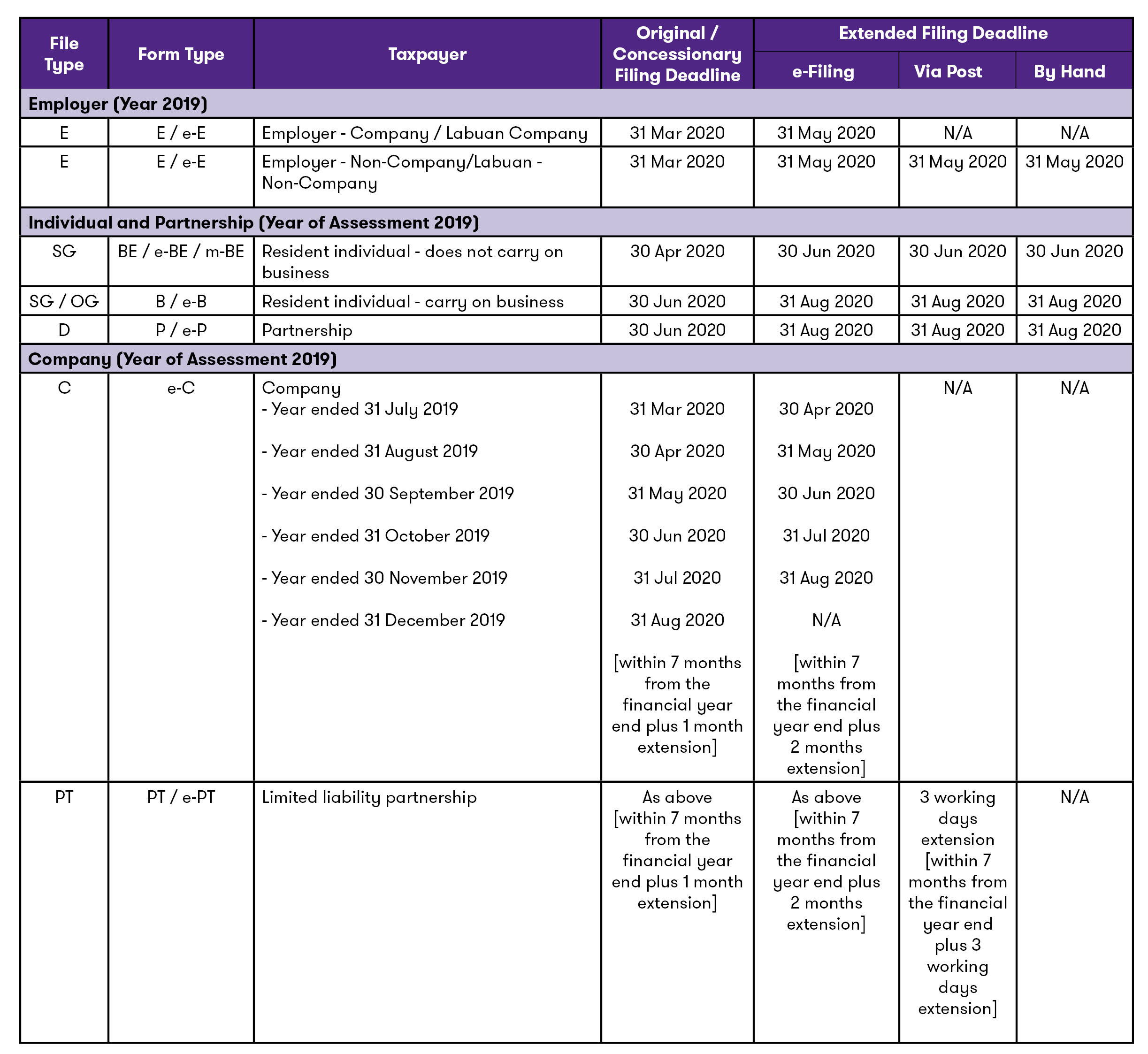

The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has. Employment income BE Form on or before 30 th April. Malaysia has a current year.

However remuneration will come within the. 30062022 15072022 for e-filing 6. B Via postal delivery.

On the first RM 600000 chargeable income. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. In line with the announcement by Prime Minister Tan Sri Muhyiddin Yassin of Malaysia on the implementation of the Movement Control Order MCO 1 to limit the outbreak.

On the First 5000 Next 15000. Under normal circumstances tax payments are due on or about April 15. TCC will be a prerequisite for taxpayers to tender for Government projects with effect from 1 January 2023.

Employment income received by women who return to the workforce after being unemployed for at least two years as of 27 October 2017 may be exempted from tax for up to 12 consecutive. Income tax return for individual with business income income other than employment income Deadline. Malaysia Personal Income Tax Rate.

The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of Tax. 30 June 2021. Employment income e-BE on or before 15 th May.

You normally must pay by that date if you havent had sufficient tax withheld from your paychecks. Form P Income tax. On the First 20000.

52019 of 16 October which explains the penalties imposed on taxpayers that fail to file. If youre a very busy person or if this is your first time doing this you might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th. The deadline moves to the next business day.

The Inland Revenue Board of Malaysia IRBM has published Operational Guideline No. The year of assessment in Malaysia is 1 January to 31 December. Malaysia Individual - Taxes on personal income Last reviewed - 13 June 2022 An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in.

Calculations RM Rate TaxRM A. Business income B Form on or before 30 th June. The basis period for a company is the financial year ending in the year of assessment.

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Personal Income Tax Guide 2020 Ya 2019

Philippines Bir Extends Deadline For Filing Of Annual Income Tax Returns To 15 May 2020

Updated March 16 Is Tax Deadline For S Corp And Partnership Extensions And Elections

Irs To Wipe Away 1 2 Billion In Late Fees From Pandemic Bloomberg

How Do I File A Business Tax Extension 2022 Forms And Tips

Malaysia Personal Income Tax Guide 2021 Ya 2020

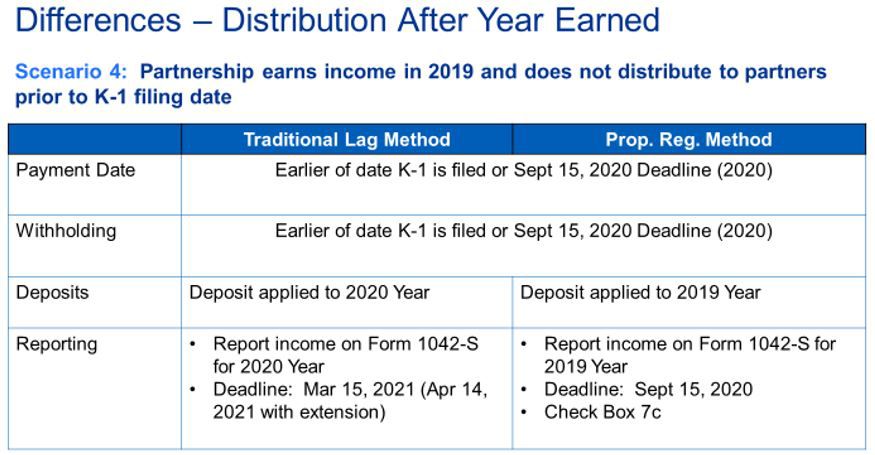

Kpmg Report Reminder About Partnership Reporting Kpmg United States

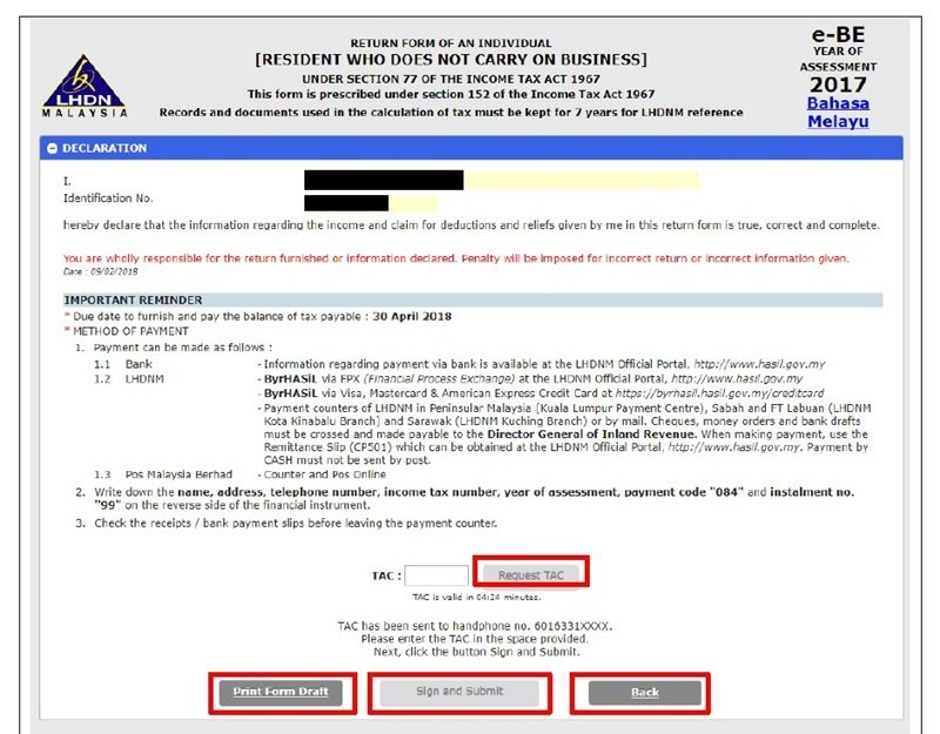

How To File Your Personal Income Tax A Step By Step Guide

Extension Of Various Tax Deadlines Grant Thornton Malaysia

Extension Due Date On Income Tax Return Form Filling Schedule 2020 Latest Updated 28 April 2020 Cheng Co Group

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

When Are Corporate Taxes Due 2022 Deadlines Bench Accounting

Features Of The Chinese Personal Annual Income Tax Settlement Rodl Partner

The Push For A Higher Worldwide Minimum Tax Rate Explained

Lhdn E Filing Due Date 2019 Malaysia Wallpaper

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

Comments

Post a Comment