gst late payment penalty malaysia 2017

October 2017 to April 2018. The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues.

Late Fee And Interest In Gst Calculator All You Need To Know

This interest is paid by the taxpayer at the.

. If farmer is not engaged in trading of other taxable goods then he is not liable to take registration under gst. In view of the impending increase in the GST rate from 7 to 8 from 1 January 2023 and subsequently to 9 from 1 January 2024 GST registered businesses are strongly encouraged to start preparation early for a smooth transition to the new GST rates. In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses.

ASCII characters only characters found on a standard US keyboard. 2017 2018 and 2019 would be extended by 85 days. 10 years in academic writing.

Output SGST RCM Ac. IRAS Document Identification Number DIN The IRASs Arms Length Principle. On the total penalty liability interest at the rate of 18 per annum is applied.

In addition to the late payment penalty. The midnight of 01 July 2017 GST came into effect after the Goods and Service Tax Act passed in the Parliament. The credit will be paid to the person whose return is assessed first.

The application for remission must be submitted to the Tax Analysis Division of the Ministry of Finance. In late April 2021 the government extended the income and interest rate support till March 2022. Total will be Rs.

October 2017 onwards. The Maharashtra legislature enacted a bill on Monday March 21 2022 to provide for the payment of tax interest penalty and late fee arrears that were due under Acts previous to the implementation of the Goods and Services Tax. 52017 Central Tax.

100 per day per Act. You can choose to pay through one of the following ways. The principles on which these penalties are based are also mentioned by law.

Responsibilities of a GST-registered Business. Reduced Late fee Condition to be satisfiedIf the date of filing was before 22nd December 2018. 6 to 30 characters long.

Strict legislative measures of payments within fixed days and penalty in the. The penalty is the amount you calculated at line 307 on the T5013 SCH 52. 275 words page.

Remission Of Sales TaxPenalty. At time of payment of gst. July 2017 -September 2017.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. So it is 100 under CGST 100 under SGST. Goods Services Tax GST Go to next level.

If any of the offenses are committed then a penalty will have to be paid under GST. Invoicing Price Display and Record Keeping. The IRS will also charge you interest until you pay off the balance.

Review your writers samples. In late September 2020 the first sovereign offering of a 3-year domestic bond of US 41 million or Nu. Payment is deemed derived from Malaysia if.

To continue receiving the GSTHST credit including any related provincial or territorial payments you have to file a return each year even if you did not receive any income in the year. TDS Late Payment Interest Calculator. Must contain at least 4 different symbols.

Get 247 customer support help when you place a homework help service order with us. 3 billion at 65 per cent was issued to support increasing fiscal needs. The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax bill.

Partnerships and Limited Liability Partnerships LLPs Taxation. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Violates the Fight Online Sex Trafficking Act of 2017 or similar legislation or promotes or facilitates prostitution andor sex trafficking.

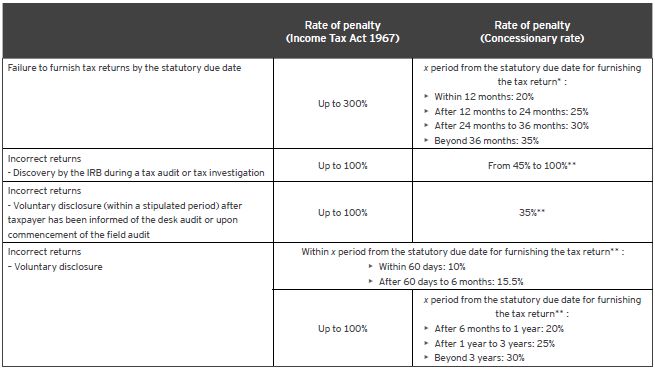

Late filing attracts penalty called late fee. The IRB may impose late payment penalties at the rate of 10 of the amount of unpaid tax. For SGD payment - Cheque at our Level 1 reception counter of our office at 8 Anthony Road Please note that Cash payment is suspended until further notice - Cheque made payable to UOB Kay Hian Pte Ltd.

How Foreign Tax Credit Is Benefiting You As A Holding Company. Line 307 Enter the amount of the late filing penalty from line 307 of the T5013 SCH 52. Penalty for Late Submission of GST Returns.

Please note that there is no processing of payment during Singapore public holidays. If you have a spouse or common-law partner only one of you can receive the GSTHST credit. When the late fee is accrued interest is also charged on non-payment of late fees.

However in cases where the delay is within 15 days the penalty is equal to 1 per day. Goods and Services Tax GST. Any person or class of persons who are required to pay sales tax or penalty may apply to the Minister for remission of such sales tax and penalty as provided under section 33 of the Sales Tax act 1972.

No returns or late deliveries and a stable average balance of receivables over time. The late fee is Rs. E-Learning Videos on GST.

Violates the Fight Online Sex Trafficking Act of 2017 or similar legislation or promotes or facilitates prostitution andor sex trafficking. Double and single spacing. 85 10.

The exemption order is deemed to have come into operation on 6 September 2017. 9712 orders delivered before the deadline. E-Learning course Overview of GST.

You can lose your refund. Adjustment notes are often used to avoid cash payment. If the delay is between 15 and 90 days the penalty is equal to 15.

12 point ArialTimes New Roman. Interest is applicable on late payment of GST liability on the net tax liability after reducing the input tax credit claims. Responsibility for payment lies with the Government or a State Government.

If the FORM GST TRAN-1 declaration has been filed on or before May 10 2018 then waived off completely. Omitted andor late payments of taxes of whichever kind and nature result in a penalty equal to 30 of the unpaidlate paid tax. If your partnership allocated renounced resource expenses to its members and has to pay a penalty under subsections 661274 and 1275 enter the amount of the penalty on line 307.

Reversal payment dispute or is charged a penalty for any fee it previously charged to your Payment Method you agree that GoDaddy may pursue all available lawful remedies in order to obtain payment. TDS Return Due Date Penalty Calculator. If you were supposed to get a refund with the late return you could lose the refund depending on how late you file.

Goods Services Tax GST Basics of GST Go to next level. Personal Tax Reliefs in Singapore. The interest has to be paid by every taxpayer who.

Reversal payment dispute or is charged a penalty for any fee it previously charged to your Payment Method you agree that GoDaddy may pursue all available lawful remedies in order to obtain payment. What It Is and How It Works. GST update Customer Accounting for Prescribed Goods.

Malaysia Penalty Relief For Late Payment Of Gst Kpmg United States

Rachita Mantry Rachitamantry Twitter

Gst Late Fees Calculator With Interest And Notification

Malaysia 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Malaysia In Imf Staff Country Reports Volume 2022 Issue 126 2022

What Are The Ramifications Of Not Filing Form Gstr 3b Enterslice

Form Cmp 08 Statement Filing Procedure Due Date Penalty Other Essential Information

Ducati Hypermotard 939 2016 2017 2018 Main Wiring Harness Loom 5101a641d Ebay

Worldwide Vat Gst And Sales Tax Guide 2022 Ey Global

Photos Brookwood Vs Norcross Football Corky Kell Classic Slideshows Gwinnettdailypost Com

Late Fees And Interest On Gst Return

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Taxnewsflash Asia Pacific Kpmg United States

Process Of Payment Under Gst Part 2 Penalty And Interest On Late Payment Of Gst Youtube

Pdf Problems In Gst Implementation And Gst Withdrawal Of Malaysian Smes

Photos Brookwood Vs Norcross Football Corky Kell Classic Slideshows Gwinnettdailypost Com

Gst Late Fees Calculator With Interest And Notification

Interest To Be Charged On Late Gst Payments From September 1

Comments

Post a Comment